Contents

15 year mortgage rates calculator – If you are looking for lower mortgage payments, then mortgage refinance can help. See if you can lower your payment today.

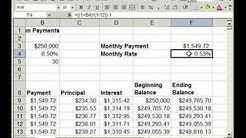

If you are looking to refinance your home, you may benefit greatly by using this mortgage refinance calculator (for home purchase mortgage, use Amortization-Calc’s home mortgage calculator).It will help you to determine if refinancing is a good idea and what you can expect to be paying in the future.

Calculator Rates Compare 15 & 30 year fixed rate mortgages. This calculator makes it easy to compare the monthly payments for any 2 fixed-rate mortgages (FRMs).. By default the left column is set to a 15-year amortization while the right column is set to a 30-year amortization, but you can change either of these terms to quickly & easily compare the monthly payments for any fixed-rate.

How can I get an estimate of my rate? Our refinance calculator uses today’s current rates. Once you enter your numbers and pressing "Calculate," you’ll see a list of recommended loans, terms and rates. If you like what you see, you can get started by contacting a Home Loan Expert or applying online with Rocket Mortgage.

How can I get an estimate of my rate? Our refinance calculator uses today’s current rates. Once you enter your numbers and pressing "Calculate," you’ll see a list of recommended loans, terms and rates. If you like what you see, you can get started by contacting a Home Loan Expert or applying online with Rocket Mortgage.

Use our Student Loan Refinancing Calculator to identify if the refinancing is the. New loan term (years). Student loan refinancing rates as low as 2.14% APR.

Usda Zip Code Eligibility Area Eligibility | USDA-FNS – Please zoom in to the map, to see the data. This map displays census data can be used for tiering of participating CACFP day care homes and eligibility of SFSP summer sites. A guide to using this map can be found by clicking on the and more information about area eligibility and the data can be found below the map.

Compare today?s mortgage and refinance rates from Citi.com. View current mortgage rates on 30 year and 15 year fixed mortgages. Get a customized rate and.

Interest Rate Commercial Real Estate Loan Interest rates on commercial loans are generally higher than on residential loans. Also, commercial real estate loans usually involve fees that add to the overall cost of the loan, including.

· Are 15-year, fixed-rate mortgages a good choice for refinancing? They often are, especially for homeowners well along in an existing 30-year mortgage; these can be used to chop years off of a remaining mortgage term, and often at the same or even lower than their current monthly payment.

Find the current rates and recent trends from SunTrust mortgage.. agency 15 Year Fixed. Interest Rate. 3.100.. Cash-Out Refinance. Tools and Calculators.

The total purchase discount for acquired loans was $21.3 million at September 30, 2019, compared to $22.6 million at June 30, 2019, and $15.4 million at September 30, 2018. In the first nine months of.

Learn more about USAA mortgage refinancing options.. Save on your monthly payment by refinancing your mortgage to a lower interest rate.. 30-Year Fixed.